August 14, 2021

by Peter Seed

Title: The Beginning of the Self-driving Wallet

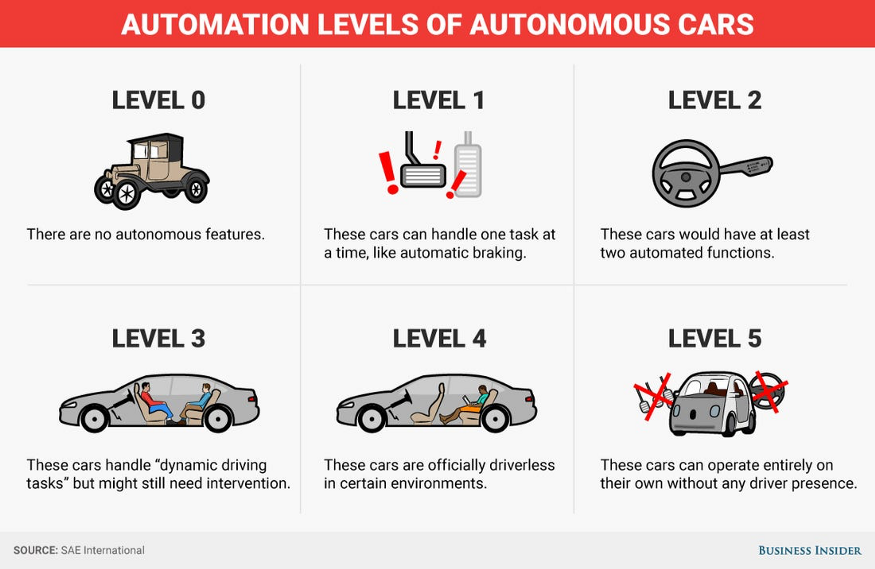

Just as self-driving cars can interpret acceleration, traffic flow and braking, self-driving wallets can analyze market trends, pick a stock and execute trade strategies.

Most investors gravitate toward equities representing companies with a track record of growth, cash in the bank and a strong management team. The idea is that healthy companies have the best chance for sustained stock appreciation.

As a pioneer in this space, currently in development, the UpTrade platform will be one of the view platforms that will be able to execute algo-driven trading on top of API-connected online brokerages. This is how UpTrade’s process will work.

First, UpTrade screens stock candidates representing healthy business fundamentals. Candidate stocks are well rated by stock analysts, have a solid quick ratio, quarter-over-quarter sales growth and a relative strength ratio less than 60 – just to name a few selection criteria. The point is, they are fundamentally solid as potential buy-and-hold candidates.

Second, rather than buying a stock at the prevailing market price, UpTrade takes basic steps to strategically time market entry into an equity position. Nobody can pick ideal times to enter a stock position 100% of the time, but the age-old adage “buy on the dip” is certainly a well-worn strategy and one that UpTrade will use on a regular basis to enter the market.

Monitoring a position by accounting for the real-time-value of money is a key factor. Machines do this very well. In phase three, UpTrade will monitor the position for an optimal exit point. Finding an optimal exit point often depends on a trader’s risk tolerance and the frequency with which a trader intends to withdrawal profits. Tax considerations also play a role.

Getting Away from the Coin Flip

Any stock pick is a coin flip as to whether it will generate a profit within a relatively short period of time. In the long run, most buy-and-hold strategies will generate a profit. But short-term investing can be a different animal. Throw meme stocks into the mix and it is nearly impossible to consistently pick winners.

A casual visit to a Reddit stock trading forum will reveal a new investment strategy worth noting – wheel trading. Basically, it is an option-trading strategy involving selling short-put options to get into a stock position and selling covered calls to get out. Traders swear by this strategy. UpTrade will automate it.

Buying on the Super Dip

Selling short options provides the potential for an additional discount on top of a normal price dip. The short-put trader enters an obligation to buy a stock at a price below the current market price. Thus, if there is a slight dip in the stock price, the short-put trader can get an additional 2% to 4% discount off the current market price by selling a put.

When the trader sells a put option, the short trader collects a premium. That premium reduces the basis cost of buying the stock if the shares are assigned at the strike price. And there is one other advantage. If the stock price goes up, the short-put trader keeps the premium without ever taking delivery of the stock. That’s called income generation. The use of short option strategies is a key piece of investment strategy that will be automated by the UpTrade platform.

Algo trading is a smart way to manage the higher risk side of an overall portfolio. No trader should go into option trading without knowing the basis, but if you grasp the concept of selling options, UpTrade wants to give you access to a smart, self-driving wallet that can generate short-term income.