The UpTrade backtester was designed for self-directed investors who understand the benefits of adjusting option positions well before option expiration.

The backtester’s short-option strategy focus includes:

-

- Covered calls

- Short Puts

- Short Strangles

Covered calls and short puts are relatively conservative option strategies. Used together, these strategies can help traders get into a desired stock position (via assignment on a short put), and then get out of a position (via assignment on a covered call) at a modest, but relatively consistent, profit.

Before we explain how the backtester works, let’s quickly review the basics of short option trading.

Here is our short list of the basics:

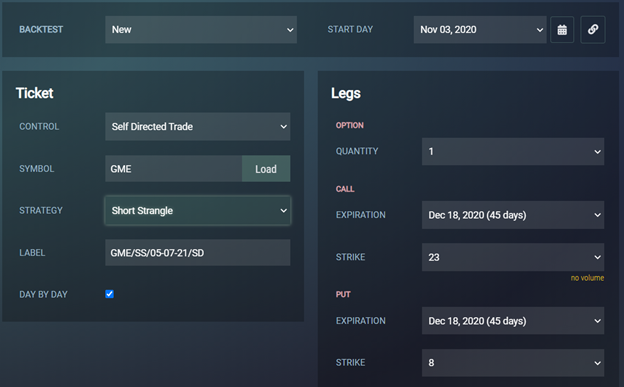

Your First Backtest

Log into UpTrade.

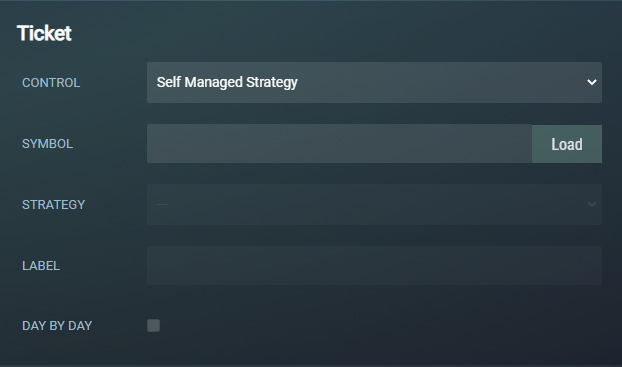

Navigate to “Backtester” from the main menu on the left side of the trade ticket. This will launch the backtester trade ticket.

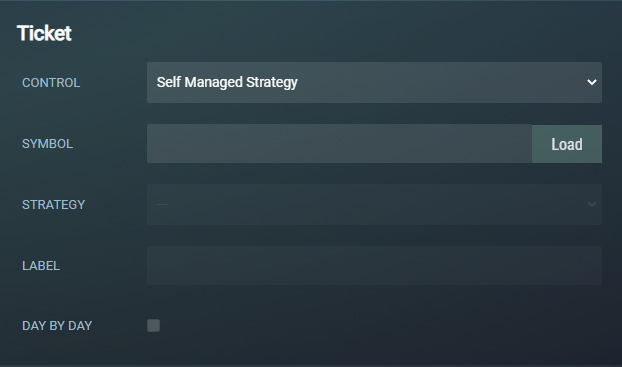

There are four fields that set up the trade.

-

-

- Control: locked down to self-managed strategy.

- Symbol: One of 600 top-volume optionable symbols.

- Strategy: Covered call, short put or short strangle.

- Label: This is automatically populated — but can be edited.

- Day-by-day Check this box whenever you want to proceed day-by-day when you hit the resume button, otherwise it will fast forward to the next date where there is an actionable prompt.

Set Your Start Date

The first thing you have to do is set the start date for your simulation. The backtester defaults to the present day, so you have to set it for a date in the past.

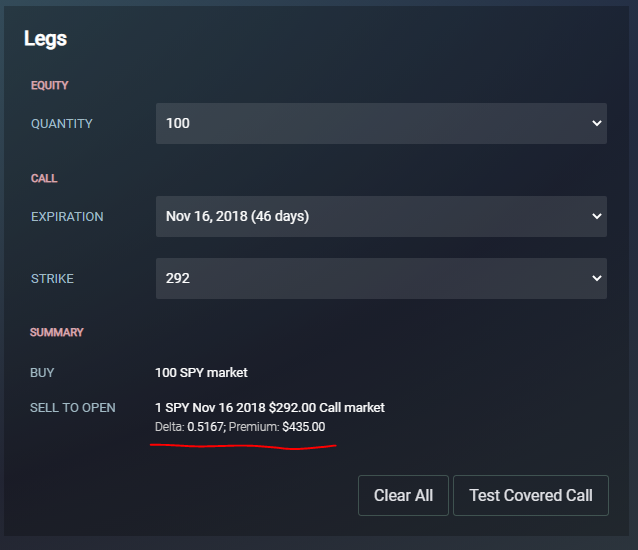

Placing your Order

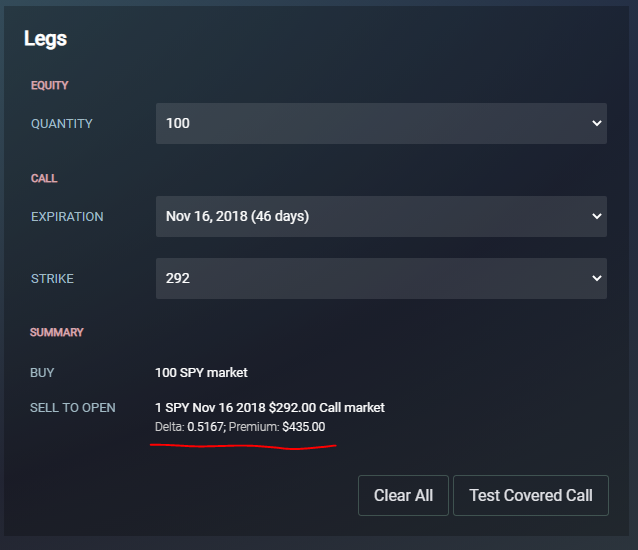

Once the strategy has been set up with a specific underlying stock symbol, a summary of the trade is displayed off to the right. Here you adjust the number of contracts and the strike price(s) you want to execute in your trade.

The backtester will offer default values for your simulated trade. The default number of contracts will be one contract — representing 100 shares of the underlying stock. The default strike prices will be at a level between 15 and 30 delta — depending on the strategy. Think of delta as the probability of the option expiring “in-the-money” — something you do not want to happen since you represent the short side of the trade. The long side of the trade likes “in-the-money”. As a short option trader, you like “out-of-the-money”. If you are short an option with 30 delta (30% chance the option will expire in-the-money) you will have a projected 70% chance of the option expiring worthless. That’s a good thing, because in that event, you get to keep the premium you collected from selling the option.

The default expiration dates are typically the next monthly expiration date closest to 45 days out. All of these values can be adjusted within certain realistic parameters.

Once you are satisfied with the setup parameters, or even if you want to accept all the defaults as they are, go ahead and press the button to execute the order. The backtester will then initiate the trade and start the testing process.

Start paying attention to the delta and premium amounts. These are metrics worth tracking.

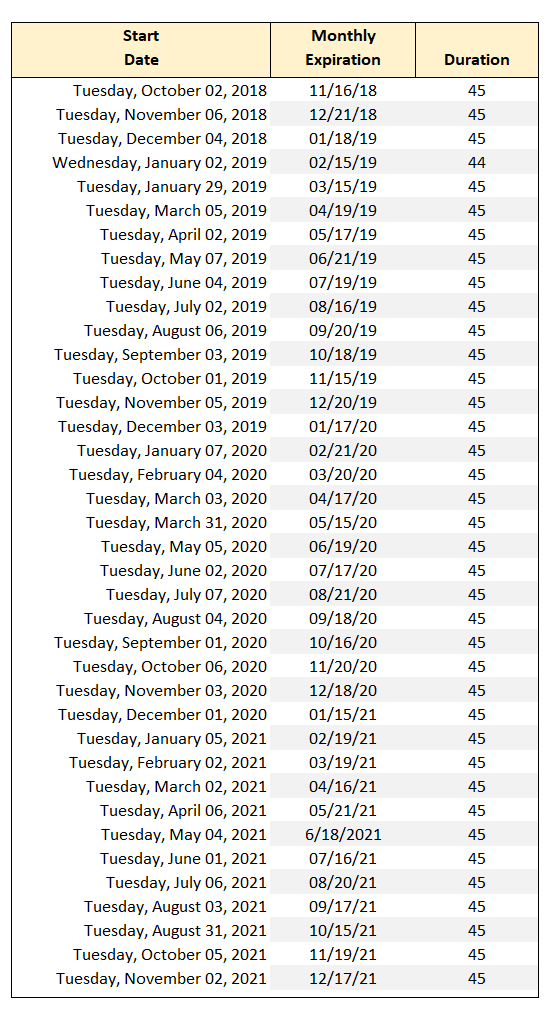

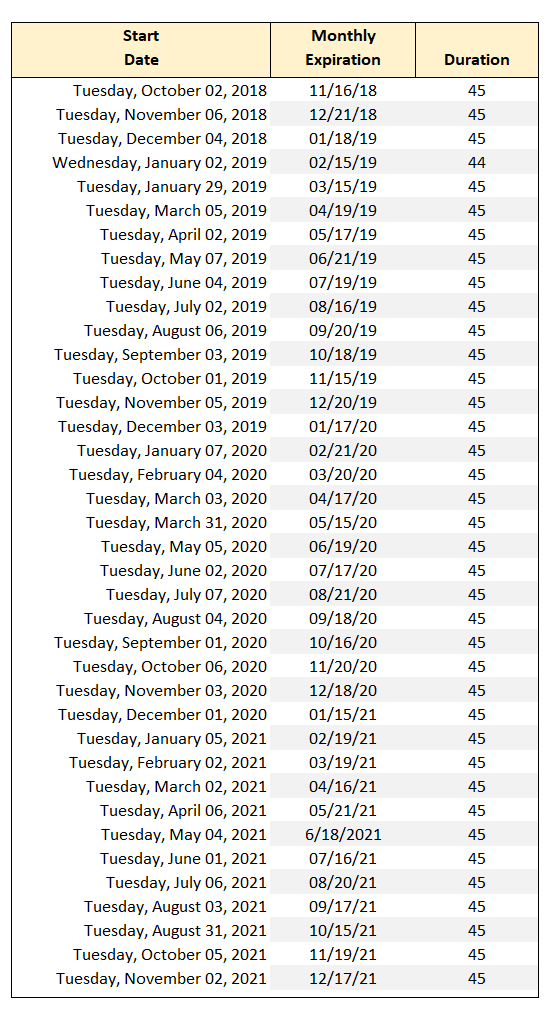

45-Day Chart

If you want to start a monthly performance spreadsheet, use the chart below to set up trades that start at the beginning of the month and expire about 45 days out.

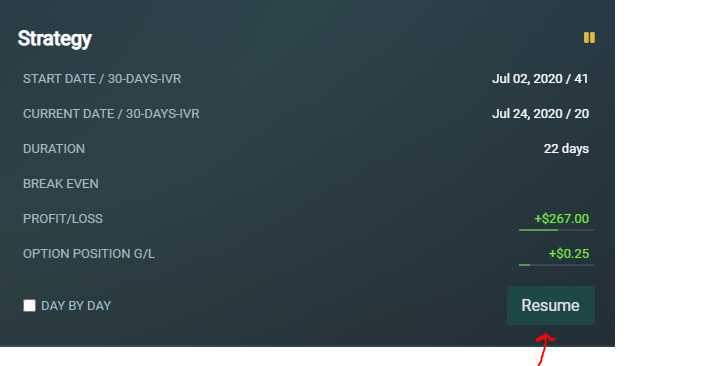

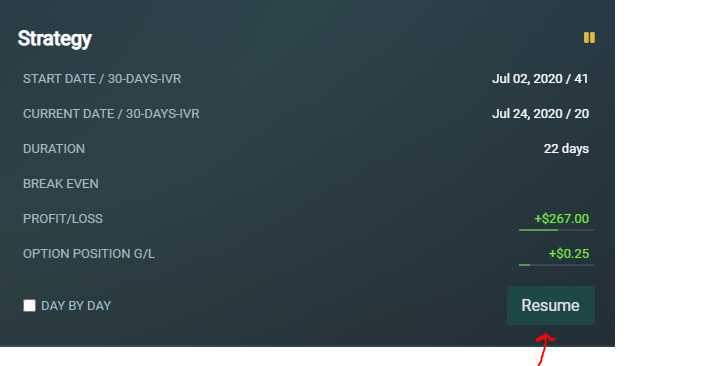

The Resume Button

Hit the “Resume” button to progress through time.

If the day-by-day box is checked, time will proceed one day per click. If the box is unchecked, time will accelerate to a date where the next significant event occurs. You can check or uncheck the day-by-day button at any time during a simulation.

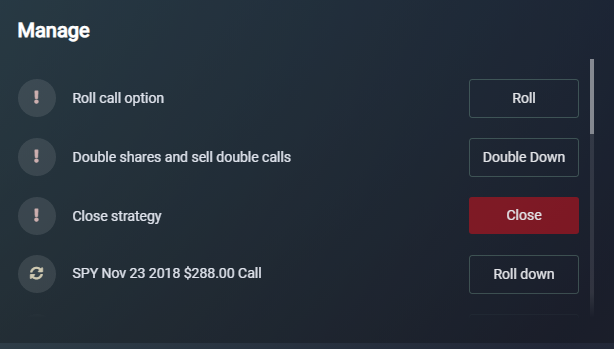

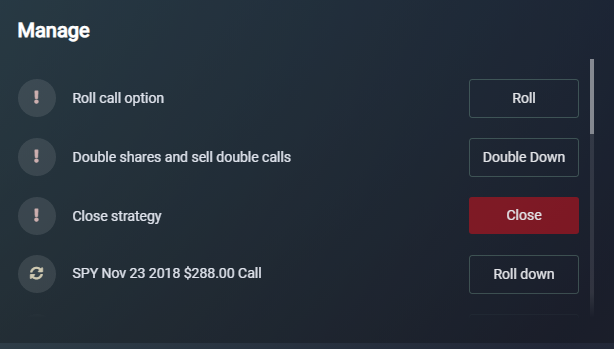

Managing with Prompts

After the strategy is traded, the right side will show flagged events called “prompts”. Once a trade is put on, the application will keep track of how much premium you have collected, what your breakeven prices points are, and whether or not your position is being “tested”. This is the robo advisor part of the application.

A position is tested when its intrinsic value exceeds the amount of premium that you have collected. Intrinsic value is also referred to as “moneyness” — the amount that a long option position is in-the-money (the long position held by the counterparty, not you). As a short option seller, you don’t like intrinsic value.

There are no 100% fail-safe moves. Instead, you often have choices that involve risk. Every adjustment has pros and cons as you will learn. Don’t worry, you will get the hang of it. You can easily repeat a simulation after you close it.

You might see certain generic prompts, such as “Close”, that are not triggered by any particular event. You may have to scroll to find those actions.

Closing a Trade

American-style options are unique because a position can be closed at any time before expiration. We strongly encourage you to close a short-option position when it hits 50% of the maximum profit. After some of the bolder defenses are implemented, you should close a position at 25% max profit, or in cases where there is little hope of profit, at breakeven.

In certain instances, you are best off closing a losing position early or managing in order to minimize a certain loss.

Short Option Traders are Cool

After spending time with the backtester, you will find that most of the management tactics are defensive in nature. Some are offensive. All of them are best executed with the knowledge that you are managing price-movement probability to your advantage.

As robo advisors for short option trading, we are part of a group of traders who believe in generating premium by leveraging probability in our favor. We like house odds. If someone needs to buy insurance, we are willing to sell insurance. If someone wants to spin the wheel of fortune, we are ready to sponsor the wheel.

We are short option traders.

Some Suggested Trading Guidelines

-

Trade Small. There are important reasons to trade small. Trading small (one contract per symbol) will allow you to diversify your positions across multiple sectors, and multiple symbols, ensuring that probability will continue to work in your favor. You can also better absorb a loss on a position that will inevitably occur from time to time. The essential concept is to trade small enough to keep some buying power in reserve. As a short-option trader, you will experience a loss. And that loss may be many times what you collected in premium. That moment will feel a lot less onerous if you trade small.

-

Manage Your Positions. As a trader of American-style options, you can close one leg of a strategy and sell a different leg before expiration. This action is called “rolling an option”. When you roll an option, the end goal is to improve your position. The UpTrade backtester is programed to identify rolling opportunities — often defensive in nature because they salvage the success of the trade. If your short-option position is ever tested (i.e. it shows a significant unrealized loss) the backtester will flag the event and stage relevant defense moves. But while defense moves can work to increase the probability of making a profit, they can also decrease the magnitude of a profit, or in certain instances, increase the magnitude of a loss. The latter will occur if the price of the underlying security moves dramatically in both directions — commonly known as a “Whipsaw” event. Ultimately, defense moves are yours to evaluate and implement.

-

Practice the Basic Trades. The UpTrade backtester excels at simulating real-life trading decisions. If you practice enough trades, you can’t help but become a better trader. The key is to use any simulated losses as a learning experience that will help you develop a better understanding of the expected risk-reward tradeoff. It’s best to start with the more conservative strategies. Trading short puts on stocks that you would not mind holding for a year or longer provides a good springboard into more complex strategies. If you are assigned shares of stock as a byproduct of selling a short put you can turn around and write covered calls to collect more premium on the shares you are assigned. When covered calls expire worthless the net effect is to lower the cost basis of the underlying shares. Don’t forget, however, that short-term profits, including premiums collected from selling short options, are taxed as ordinary income.

-

Ease into Short Strangles. Finally, feel free to experiment selling short strangles, a strategy reserved for the most experienced option traders. Short strangles are often cited as the prime example of a short option strategy where the trader assumes “undefined risk”. That probably does not sound so good if there are limits to how much you can afford to lose. Short strangles are not for the faint of heart. But they are certainly entertaining. And if you accept the notion that you will be staring down the barrel of a big loss, from time to time, they can deliver the highest rate of return on capital.